Everything about Accountants Qualifications

Wiki Article

How Accountants Qualifications can Save You Time, Stress, and Money.

Table of ContentsTop Guidelines Of Accountants ServicesThe Basic Principles Of Accountants Near Me The Best Strategy To Use For Accountants ResponsibilitiesThe Best Guide To Accountants ServicesThe Single Strategy To Use For Accountants Qualifications

Some markets this may not use as well as you'll only be called for to work the typical 40-hour job week. Typically, team accounting professionals need a bit of an education to locate a work.

In order to become a CPA, you need to have a Bachelor's degree in Bookkeeping, Financing, Organization Administration, or a relevant area (accountants firms). As suggested in the name, you require to get an accreditation to load the duty, and also this is usually preceded by years of experience in the area as a public accountant.

More About Accountants Qualifications

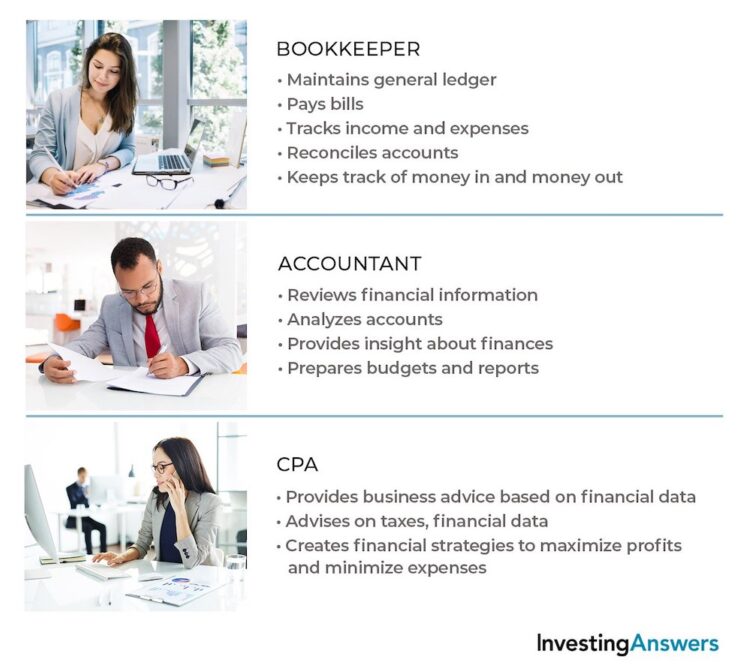

Average Wage: $60,528 Level: Bachelor's Level, View More Mouse over a state to see the number of active accountant tasks in each state. The darker areas on the map program where accounting professionals earn the highest salaries across all 50 states. Average Salary: Job Openings:.An accountant's task is to preserve total records of all money that has come right into as well as gone out of the company. Their records allow accountants to do their jobs.

As soon as you understand what tasks you require the bookkeeper to do, approximate how much time it will require to finish those jobs. Based upon that computation, decide if you need to work with a person full-time, part-time or on a job basis. If you have intricate publications or are bringing in a great deal of sales, employ a certified or accredited accountant.

Exactly how should we record these deals? Once the accountant chooses exactly how to handle these deals, the accountant carries them out." The audit process produces reports that bring vital aspects of your organization's financial resources with each other to give you a complete image of where your finances stand, what they mean, what you can and also must do concerning them, as well as where you can expect to take your business in the close to future.

The Best Guide To Accountants Firms

To finish the program, accounting professionals have to have 4 years of relevant work experience. A CIA is an accountant who has been certified in conducting interior audits.Bureau of Labor Data, the typical wage for an accounting professional in 2020 was $73,560 per year, or $35. 37 per hr. Their years of experience, your state and the complexity of your accounting needs impact the price. Accountants will certainly either price estimate a client a set price for a details service or bill a basic hourly price.

It can be hard to determine the appropriate time to employ a bookkeeping expert or bookkeeper or to determine if you require one in any way. While many tiny businesses employ an accountant as a specialist, you have several options for taking care of economic tasks. For instance, some small company owners do their very own bookkeeping on software application their accounting professional suggests or makes use of, providing it to the accounting professional on a regular, monthly or quarterly basis i thought about this for activity.

It might take some background study to discover an appropriate accountant since, unlike accounting professionals, they are not needed to hold an expert qualification. Right here are 3 circumstances that indicate it's time to work with a monetary specialist: If your taxes have actually come to be as well complicated to manage on your own, with numerous income streams, international investments, several deductions or other considerations, it's time to hire an accountant - accountants qualifications.

The Greatest Guide To Accountants And Auditors

You can begin by contracting with an accountant who balances the books when a month and also a CPA that manages your tax obligations. Then, as your bookkeeping requires increase, bring someone on team. Whether you employ an accounting professional, an accountant, or both, guarantee they're certified by requesting customer references, looking for accreditations, or useful reference carrying out screening tests.There are a number of paths to ending up being an accountant. You need to explore these paths to becoming an accountant to discover out which is the best one for you.

Newly trained accounting professionals can earn 17,000 - 25,000 Trained accountants with some experience can earn 29,000 - 55,000 Senior or chartered accounting professionals can gain 60,000 - 80,000. * Hours and wage depend on place, company and any overtime you may do. Salaries and also profession options enhance with chartered status. * Incomes have actually been collected from multiple market sources Check out the most recent accountant jobs: As these are external sites, the variety of vacancies connected to your favored function may differ.

You may start as a student or accounts aide and function your method up to a junior or aide accounting More Help professional whilst you are part qualified. Once you are a totally certified accountant, you might become an elderly accounting professional or operate in management and also make a higher wage. At some point, you could end up being a financing director.

How Accountants And Auditors can Save You Time, Stress, and Money.

You'll require to have three years' job experience in an appropriate role to sign up. As an accountant, you might work in the public or private field.Something failed. Wait a minute and also try again Try once more.

The need for accountants is mainly driven by globalization and also the increasingly complicated governing setting in which we all now live. As routine tasks end up being automated, accountants will be expected to move away from basic bookkeeping and rather take on an extra calculated and also consultatory function for their customers.

Based on these searchings for, an accounting professional can then assist a company or private develop a financial objective and also plan how to achieve that objective (accountants qualifications). Whether you're considering coming to be an accountant or hiring one, this write-up will cover all the fundamentals. We'll review: Bookkeeping isn't necessarily the most extravagant appearing task, however it is among one of the most essential ones.

Report this wiki page